Ensure investor funds are fully reconciled and accounted for, using automated workflows and detailed reporting, to reduce risk and enhance accuracy in managing transfer agency accounts.

Automate reconciliation processes

- Daily reconciliation of all cash transactions at investor level as well as the movements between the operating account and the TA account.

- Our Unapplied Items Summary allows you to see at a transactional level what money is sitting in your collection accounts, enabling compliance with IMR, CASS, and other investor money legislation.

- Our unique 2 step reconciliation process allows you to match one deal from the deal board against two money movements at the bank.

Comprehensive error reduction

- TA Recs are not just another Cash Rec. Our TA Rec solution is built specifically with the nuances of Investor Money in mind.

- Generate Fund, Team and Company level reporting for clients, management and even regulators on demand.

- Built in MIS to track efficiency and automation metrics.

Take Action. Drive Results.

With decades of experience, we've seen it all. See how we add value around the edges.

Rule your data

Users set customisable tolerances to define matching and break criteria, giving them the ability to define rules based on any data point.

In & out

Break the rec down into two steps: cash in and cash out. Our review page helps to reduce risk, by ensuring every cash movement has an approved transaction.

Bulk mode

Complete recs per transaction type and currency. It’s easy to categorise and reconcile bulk money movements. Data is split per transaction type, Subs, Red, Dist etc and added to the relevant category.

More please

Want to know more before talking to one of the Fund Recs team? We understand and we've got what you need.

.

Trusted by industry-leading companies worldwide

Resources

Everything you need to know - the latest webinars, whitepapers, and blog articles.

SuMi TRUST chooses Fund Recs for EMIR Solution

Dublin, April 18th, 2024 - We're pleased to share that SMT Fund Services (Ireland) Limited (“SMT”) has chosen Fund Recs for our innovative EMIR reconciliation solution. This decision highlights SMT’s...

Read Post

Maples Group Enhances EMIR Reconciliations with Fund Recs

Dublin, May 10th 2024 - Fund Recs, a leading provider of cloud-based reconciliation software for the global funds industry, is excited to announce that the Maples Group has integrated its innovative...

Read Post

Navigating EMIR Refit 2024: 6 Key Considerations

The European Market Infrastructure Regulation (EMIR) Refit, set to come into effect on 29th April 2024, introduces several changes. In December of last year, ESMA released the final report on...

Read Post

ASIC Basics: Part one

Introduction The Australian Securities and Investments Commission (ASIC) is rolling out game-changing updates to over-the-counter (OTC) derivative transaction reporting, effective from 21 October...

Read Post

EMIR Re-fit: Lessons Learned

Looking back on the European OTC derivative transaction reporting re-write as the mirror Australian ASIC deadline in October fast approaches. Within the world of derivative transaction reporting, for...

Read Post

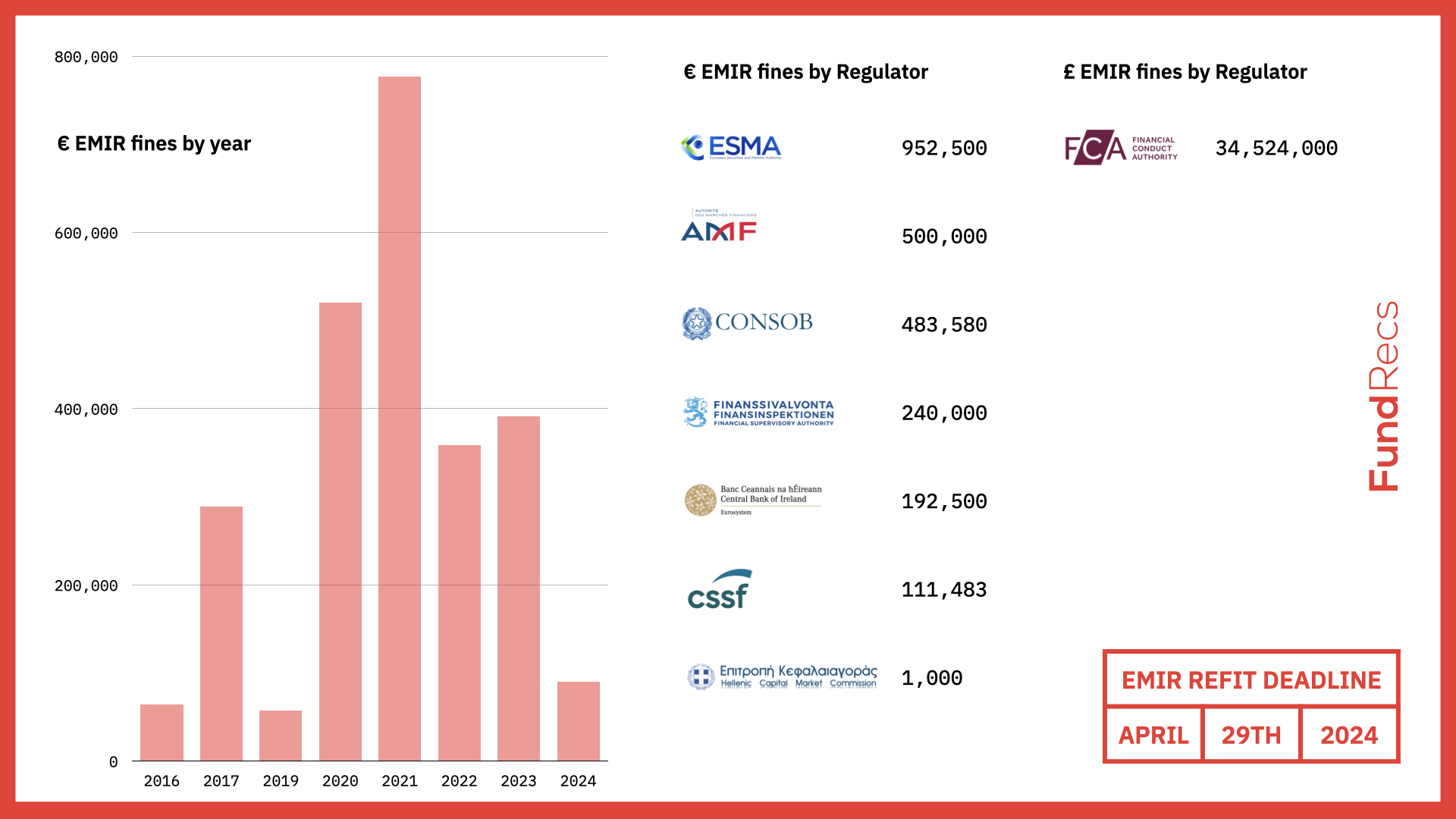

A Complete History of EMIR Fines

We've put together a Complete History of EMIR Fines. Drop me an email if we missed any: alan@fundrecs.com

Read Post