Efficiently manage and track assets with comprehensive oversight, allowing for the creation and management of assets, tracking documentation, and accessing detailed transaction histories.

Efficient asset tracking

- Create assets quickly on the Register via the UI or enable auto creation based on transaction types in the cashflow.

- Checklist for required documentation will show based on Asset Class Type, allowing you to customise the data required.

- Download period end Register with all backup docs at any time for reporting to senior management, clients or regulators.

Centralise reporting

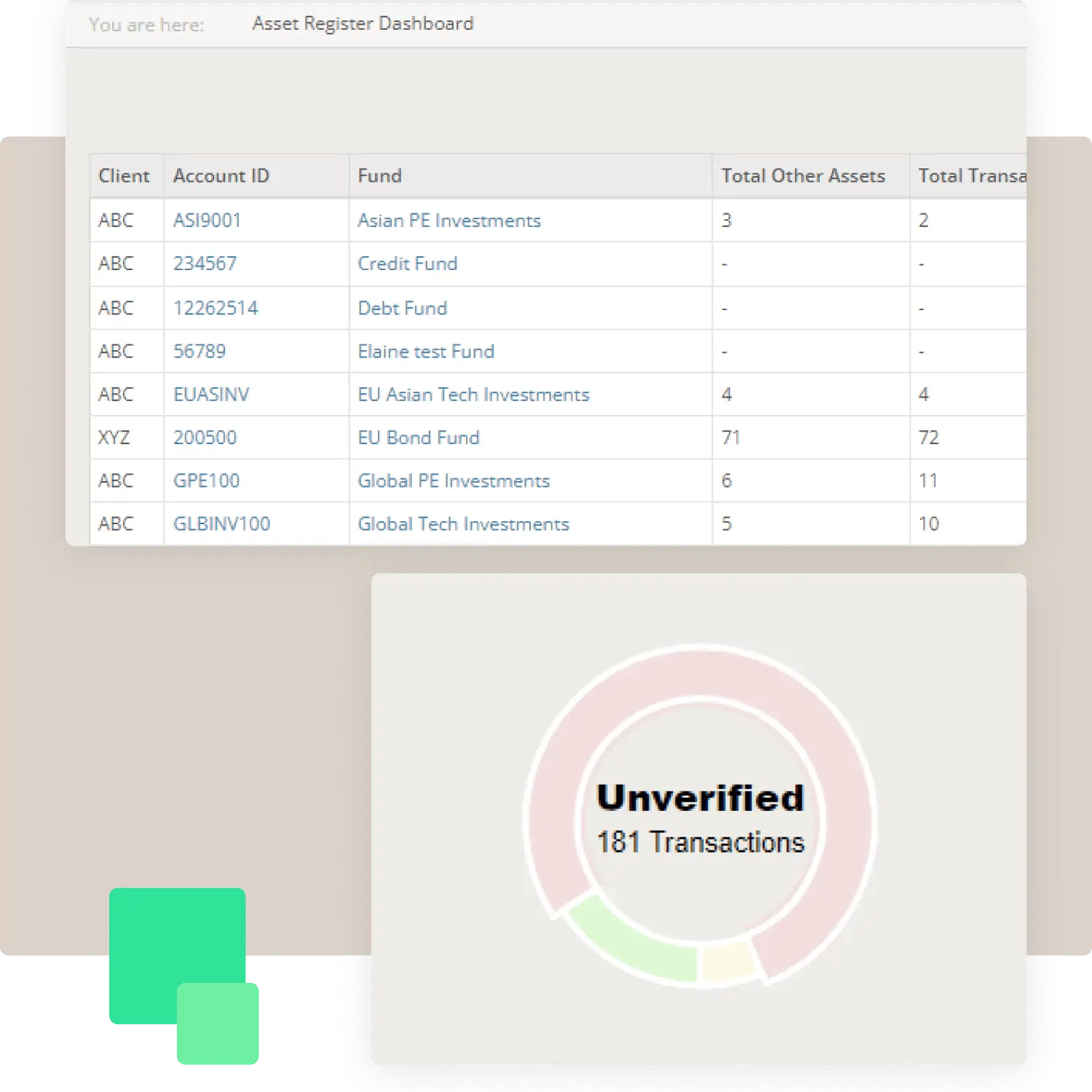

- Fund, Team and Company level dashboards allow management to get a holistic view of what’s done, and what’s to be done.

- Ensure you’re complying with regulatory obligations at all times with an up-to-date register with all documentation available.

- Audit trails throughout to track manual intervention and missing info.

Take Action. Drive Results.

With decades of experience, we've seen it all. See how we add value around the edges.

Flexible Data Ingestion

Using our no code interfaces, business users can map any data file format, PDF, Excel, XLS, XML, CSV and more, from any data source. This fully automates the data ingestion and normalisation process.

For Depository, by Depository

We've partnered with and sought feedback from some of the leading talent in the Depository world to ensure our solution is best of breed for Depositories.

Live Dashboards

The dashboard shows a list of all funds within a team and their live status. Users will also be able to see a detailed breakdown of each asset and checklist, quickly highlighting missing items from the register.

More please

Want to know more before talking to one of the Fund Recs team? We understand and we've got what you need.

.

Trusted by industry-leading companies worldwide

Resources

Everything you need to know - the latest webinars, whitepapers, and blog articles.

SuMi TRUST chooses Fund Recs for EMIR Solution

Dublin, April 18th, 2024 - We're pleased to share that SMT Fund Services (Ireland) Limited (“SMT”) has chosen Fund Recs for our innovative EMIR reconciliation solution. This decision highlights SMT’s...

Read Post

Maples Group Enhances EMIR Reconciliations with Fund Recs

Dublin, May 10th 2024 - Fund Recs, a leading provider of cloud-based reconciliation software for the global funds industry, is excited to announce that the Maples Group has integrated its innovative...

Read Post

Navigating EMIR Refit 2024: 6 Key Considerations

The European Market Infrastructure Regulation (EMIR) Refit, set to come into effect on 29th April 2024, introduces several changes. In December of last year, ESMA released the final report on...

Read Post

ASIC Basics: Part one

Introduction The Australian Securities and Investments Commission (ASIC) is rolling out game-changing updates to over-the-counter (OTC) derivative transaction reporting, effective from 21 October...

Read Post

EMIR Re-fit: Lessons Learned

Looking back on the European OTC derivative transaction reporting re-write as the mirror Australian ASIC deadline in October fast approaches. Within the world of derivative transaction reporting, for...

Read Post

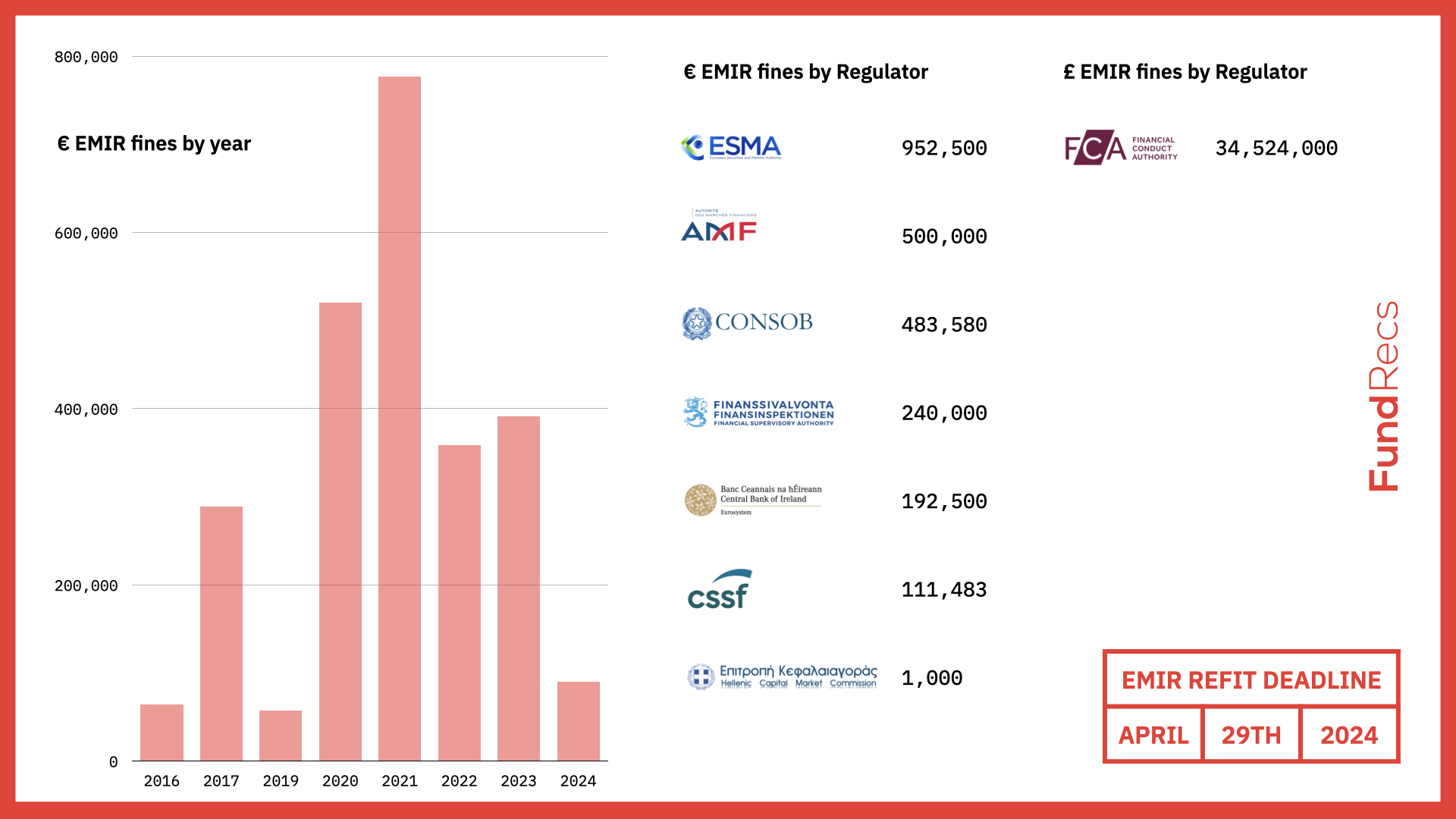

A Complete History of EMIR Fines

We've put together a Complete History of EMIR Fines. Drop me an email if we missed any: alan@fundrecs.com

Read Post