Automate the reconciliation of positions, ensuring accurate comparison of data between internal records and third-party sources. Streamline daily workflows with flexible, auto-matching processes that improve efficiency.

Configurable position recs

- Customisable rules engine allows users to set matching logic at a granular level

- Aging and Basis point calculations to ensure you’re focusing on the highest impact items

- Global Mappings tables enable high automatch rates even with non-matching Security IDs

Insight and oversight

- Flexible reporting module allows you to deliver custom client reporting at scale

- Built in MIS to track efficiency and automation metrics

- Team and Company level dashboards allow management to get a holistic view of what’s done, and what’s to be done.

Take Action. Drive Results.

With decades of experience, we've seen it all. See how we add value around the edges.

Flexible Data Ingestion

Business users can map any data file format - PDF, Excel, XLS, XML, CSV and more, from any data source. This fully automates the ingestion and normalisation process.

Matches made easy

Users add rules to allow rows auto-match via multiple security ID’s, amounts and / or currency, with any difference above your predefined tolerance reflected as a break.

Flexible Recs

Reconcile all security types within the standard, futures, or forwards tabs. Reconcile at position level, lot level or by leg, incorporating equities, bonds, EDTs and OTCs.

More please

Want to know more before talking to one of the Fund Recs team? We understand and we've got what you need.

Trusted by industry-leading companies worldwide

Resources

Everything you need to know - the latest webinars, whitepapers, and blog articles.

SuMi TRUST chooses Fund Recs for EMIR Solution

Dublin, April 18th, 2024 - We're pleased to share that SMT Fund Services (Ireland) Limited (“SMT”) has chosen Fund Recs for our innovative EMIR reconciliation solution. This decision highlights SMT’s...

Read Post

Maples Group Enhances EMIR Reconciliations with Fund Recs

Dublin, May 10th 2024 - Fund Recs, a leading provider of cloud-based reconciliation software for the global funds industry, is excited to announce that the Maples Group has integrated its innovative...

Read Post

Navigating EMIR Refit 2024: 6 Key Considerations

The European Market Infrastructure Regulation (EMIR) Refit, set to come into effect on 29th April 2024, introduces several changes. In December of last year, ESMA released the final report on...

Read Post

ASIC Basics: Part one

Introduction The Australian Securities and Investments Commission (ASIC) is rolling out game-changing updates to over-the-counter (OTC) derivative transaction reporting, effective from 21 October...

Read Post

EMIR Re-fit: Lessons Learned

Looking back on the European OTC derivative transaction reporting re-write as the mirror Australian ASIC deadline in October fast approaches. Within the world of derivative transaction reporting, for...

Read Post

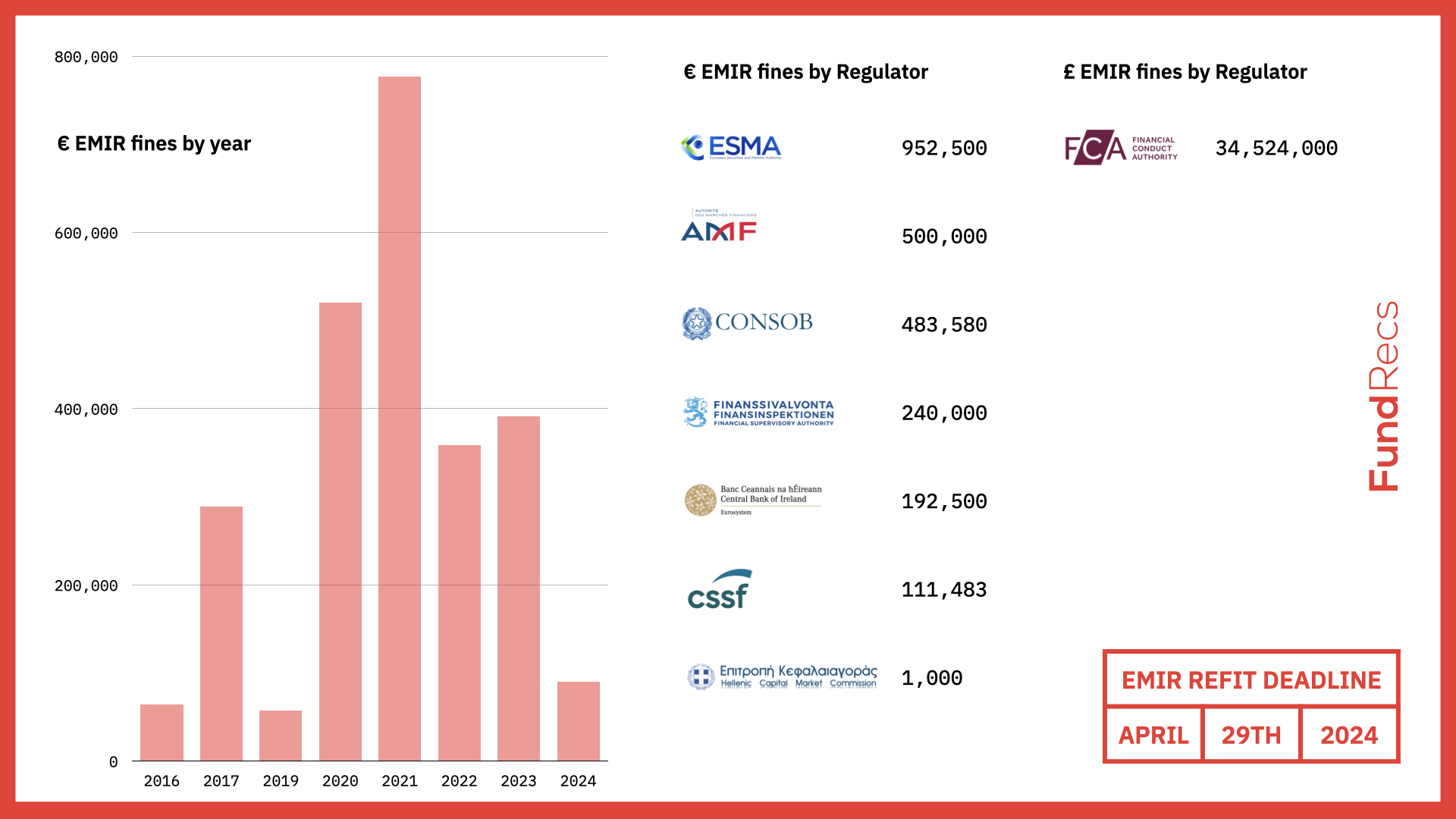

A Complete History of EMIR Fines

We've put together a Complete History of EMIR Fines. Drop me an email if we missed any: alan@fundrecs.com

Read Post