Latest News & Insights

When Share Classes Drift: Why Tolerance-Led Exceptions Matter

Learn how tolerance-led exceptions in multi-share class funds ensure accurate NAVs, robust oversight, and investor confidence by addressing divergences...

Read Post

Out of Time: Why Late EMIR Reports Are Riskier Than You Think

Understand the risks of late EMIR reports and learn how to ensure timely compliance to avoid regulatory issues and demonstrate robust control.

Read Post

Wimbledon & Recs: What Tennis Teaches Us About Data Accuracy

Wimbledon processes over 2.7 million data points each year. This blog explores what fund operations can learn from how the tournament handles real-time data...

Read Post

Delivering a robust technology solution for EMIR reconciliations.

Fund Recs deliver a robust technology solution for EMIR reconciliations for their client, a leading investment manager with their own UCITS ManCo.

Read Post

Private Markets Are Booming - But Operations Are Feeling the Strain

Discover the key operational challenges in private markets and learn how leading firms are addressing fragmented data, manual processes, and evolving...

Read Post

One Year of EMIR Refit: One Year On

Discover how Fund Recs' EMIR solution helped clients tackle new regulatory requirements with ease and efficiency over the past year.

Read Post

OneNexus Outsourcing Services LLP Partners with Fund Recs to Enhance Outsourced Solutions

OneNexus partners with Fund Recs to enhance financial services through automation and outsourcing, offering clients faster, scalable reconciliation and data...

Read Post

Global coverage, local precision

Discover the latest OTC derivatives regulatory updates in Hong Kong and Canada, and learn how to stay compliant with new reporting and risk management...

Read Post

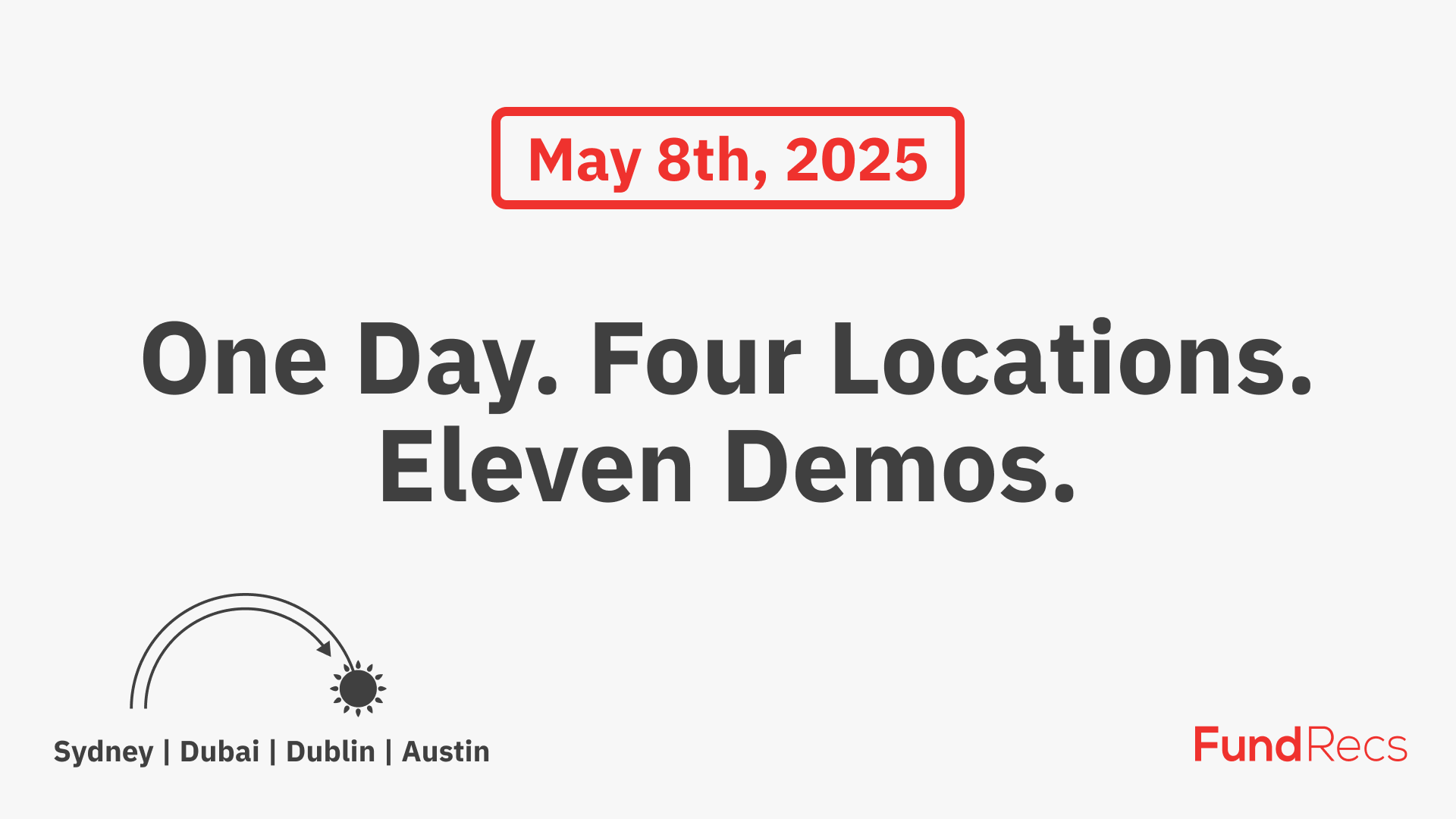

Fund Recs Global Demo Day

Ensure accurate NAV oversight with Fund Recs' automated solutions for data reconciliation and regulatory compliance, enhancing operational efficiency and...

Read Post

Why NAV Oversight Matters

Ensure accurate NAV oversight with Fund Recs' automated solutions for data reconciliation and regulatory compliance, enhancing operational efficiency and...

Read PostSubscribe to our newsletter

Subscribe to our newsletter for the latest news from Fund Recs.